Crypto market cycles are critical to understanding the dynamics of trading in the cryptocurrency space. Whether you’re a seasoned investor or a newcomer, recognizing these cycles can significantly enhance your trading strategy. In this article, we’ll dive deep into the crypto market cycles, exploring their stages, significance, and how to leverage them for buying and selling decisions.

What Are Crypto Market Cycles?

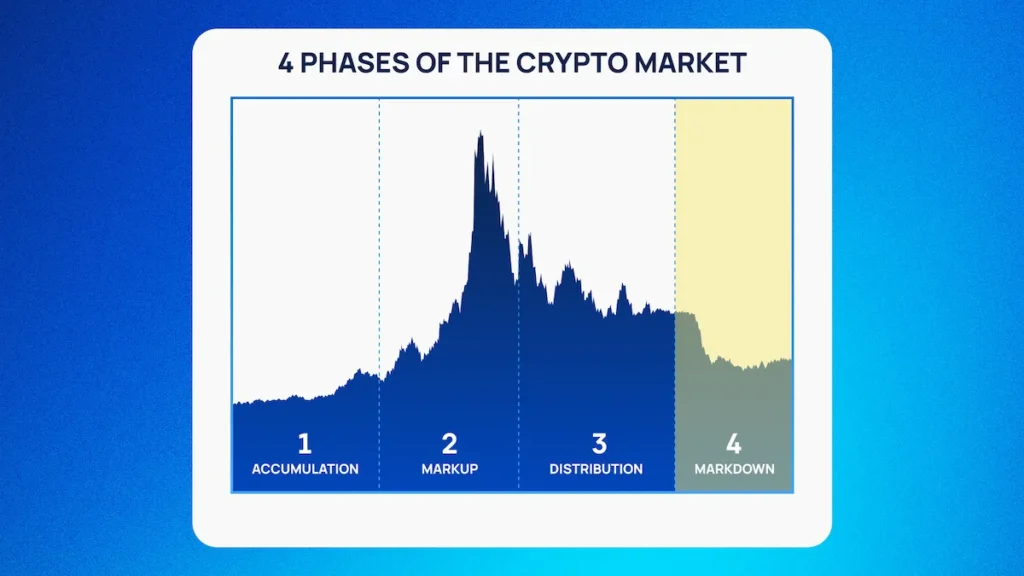

At its core, a crypto market cycle refers to the patterns of price movements within the cryptocurrency market over time. These cycles can be broadly divided into four key phases:

- Accumulation Phase

- Uptrend Phase

- Distribution Phase

- Downtrend Phase

Each phase represents different market sentiments and trading opportunities. Understanding these cycles can help you make informed decisions on when to buy and sell.

1. The Accumulation Phase

The accumulation phase is the first stage of crypto market cycles. It typically occurs after a prolonged downtrend, where prices stabilize at a lower level.

Characteristics of the Accumulation Phase:

- Market Sentiment: During this phase, market sentiment is often bearish, with many traders feeling uncertain about the future.

- Price Movement: Prices tend to move sideways as savvy investors begin to accumulate assets at lower prices.

- Volume: Trading volume may decrease as many traders wait for a clearer market direction.

How to Take Advantage:

To leverage the accumulation phase, keep an eye on the market for signs of stabilization. Consider entering positions in strong cryptocurrencies with solid fundamentals, as these can provide significant returns when the market begins to shift.

2. The Uptrend Phase

Following the accumulation phase, the market often enters the uptrend phase, marked by rising prices and positive market sentiment.

Characteristics of the Uptrend Phase:

- Market Sentiment: Investor confidence grows, leading to increased buying activity and a bullish sentiment.

- Price Movement: Prices rise steadily, creating higher highs and higher lows on the chart.

- Volume: Trading volume increases as more investors enter the market.

How to Take Advantage:

During the uptrend phase of the crypto market cycles, it’s crucial to identify the right moments to enter and exit trades. Use technical indicators and tools such as moving averages to determine the strength of the trend and potential pullbacks for optimal entry points.

3. The Distribution Phase

After a significant uptrend, the market may enter the distribution phase, where savvy investors start to take profits.

Characteristics of the Distribution Phase:

- Market Sentiment: Sentiment can be mixed, as some traders remain optimistic while others begin to take profits.

- Price Movement: Prices may flatten out or show signs of volatility, indicating that the market is reaching a peak.

- Volume: Trading volume can spike as investors rush to sell their positions.

How to Take Advantage:

Recognizing the distribution phase can be tricky. Look for signs of exhaustion in the uptrend, such as decreasing volume or bearish candlestick patterns. This can indicate it may be time to take profits or tighten stop-loss orders.

4. The Downtrend Phase

The final phase of the crypto market cycles is the downtrend phase, marked by declining prices and negative sentiment.

Characteristics of the Downtrend Phase:

- Market Sentiment: Fear and uncertainty dominate the market, leading to panic selling among many investors.

- Price Movement: Prices fall sharply, creating lower lows and lower highs on the chart.

- Volume: Trading volume may vary, but spikes often occur during significant price drops.

How to Take Advantage:

While the downtrend phase can be challenging, it can also present unique opportunities. Consider dollar-cost averaging into your favorite cryptocurrencies, as buying during these lows can set you up for substantial gains in the next cycle. Additionally, maintaining a diversified portfolio can help mitigate risks during downturns.

Recognizing Crypto Market Cycles: Key Indicators

Understanding the crypto market cycles requires keen observation of various indicators. Here are some crucial tools to help you identify these cycles:

- Moving Averages: Utilize short-term and long-term moving averages to determine overall market trends.

- Relative Strength Index (RSI): The RSI can help identify overbought or oversold conditions, indicating potential reversals.

- Volume Analysis: Monitor trading volumes to confirm trends. Increasing volume during price rises often signals strength.

- Market Sentiment: Keep an eye on social media and news outlets to gauge overall market sentiment.

How to Navigate Crypto Market Cycles Effectively

To effectively navigate crypto market cycles, consider the following strategies:

- Educate Yourself: Stay informed about market trends, new technologies, and upcoming regulations. Knowledge is your best tool in making sound investment decisions.

- Diversify Your Portfolio: Spread your investments across various cryptocurrencies to reduce risk.

- Set Clear Goals: Determine your investment goals and risk tolerance. Having a plan in place can help you avoid emotional trading decisions.

- Stay Disciplined: Follow your trading plan and avoid the temptation to chase market trends impulsively.

Conclusion

Understanding crypto market cycles is crucial for anyone looking to succeed in cryptocurrency trading. By recognizing the different phases of these cycles and leveraging key indicators, you can make informed decisions about when to buy and sell. Whether you’re just starting out or looking to enhance your trading strategy, mastering the art of navigating crypto market cycles will put you on the path to success.