When it comes to trading, understanding the strategies available is crucial for your success. In the world of trading, two popular methods stand out: day trading vs. swing trading. Both strategies have their unique advantages and drawbacks, making it essential to determine which one aligns with your goals and lifestyle. In this article, we will explore the key differences between day trading vs. swing trading, helping you make an informed decision about which strategy is right for you.

1. Understanding Day Trading

Day trading vs. swing trading starts with understanding what day trading entails. Day trading refers to the practice of buying and selling financial instruments within the same trading day. Traders aim to capitalize on small price fluctuations throughout the day, often executing multiple trades to maximize their gains.

Benefits of Day Trading

- Quick Profits: Day traders can realize profits quickly since they close their positions by the end of the trading day.

- No Overnight Risk: By not holding positions overnight, day traders avoid risks associated with after-hours market movements.

- Active Trading Environment: Many traders enjoy the fast-paced environment of day trading, which can be both thrilling and rewarding.

Challenges of Day Trading

- Requires Significant Time Commitment: Successful day trading demands constant monitoring of the markets throughout the trading day.

- Emotional Strain: The rapid pace can lead to emotional stress, making it challenging to stick to a trading plan.

- High Transaction Costs: Frequent trading can result in high commission fees, which can eat into profits.

2. Understanding Swing Trading

On the other hand, swing trading focuses on capturing price movements over a longer time frame, typically from several days to weeks. Traders utilizing this strategy aim to profit from “swings” in the market rather than short-term fluctuations.

Benefits of Swing Trading

- Less Time Intensive: Swing traders do not need to monitor the markets constantly, allowing for a more flexible schedule.

- Potential for Larger Gains: By holding positions longer, swing traders can benefit from more substantial price movements.

- Less Emotional Strain: The slower pace of swing trading allows traders to make more thoughtful decisions without the pressure of rapid market changes.

Challenges of Swing Trading

- Exposure to Overnight Risk: Swing traders may be affected by news or events that occur after market hours, impacting their positions.

- Requires Patience: It can take longer to realize profits compared to day trading, which may not suit everyone’s temperament.

- Market Timing: Identifying the right time to enter and exit trades can be more challenging with this strategy.

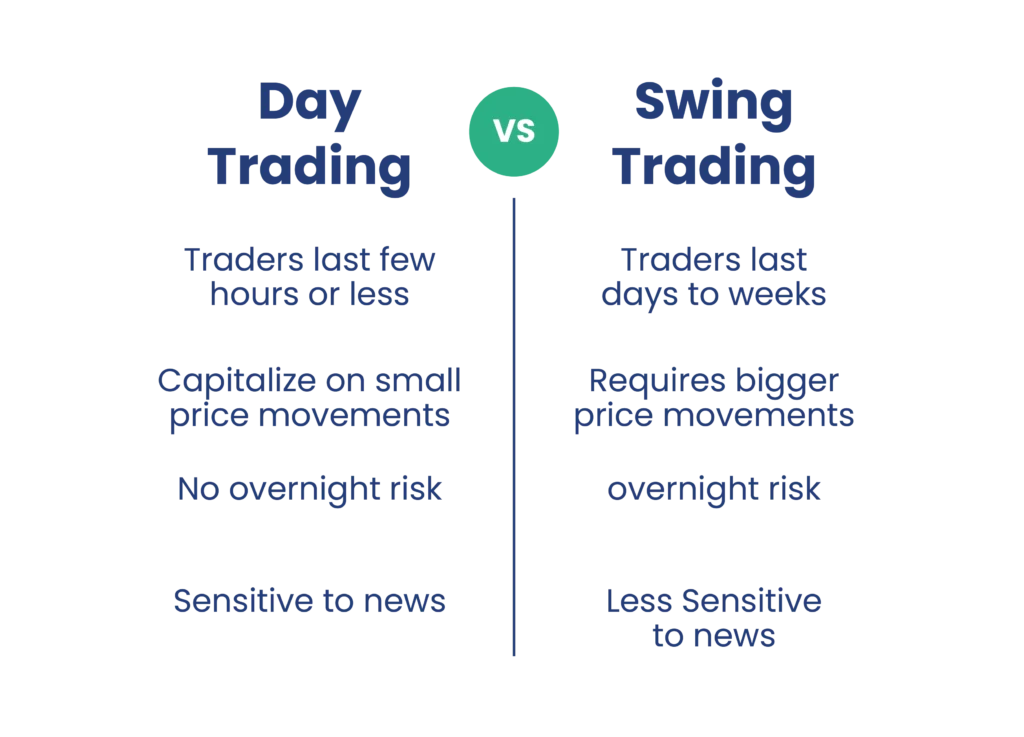

3. Key Differences: Day Trading vs. Swing Trading

Understanding the differences between day trading vs. swing trading is crucial for determining which strategy suits you best. Here are the five key distinctions:

3.1. Time Commitment

- Day Trading: Requires a full-time commitment during market hours. Day traders need to be present for the entire trading session.

- Swing Trading: Allows for a more flexible schedule, with traders only needing to check their positions periodically.

3.2. Trading Frequency

- Day Trading: Involves multiple trades within a single day, sometimes executing dozens of trades.

- Swing Trading: Typically involves fewer trades, focusing on holding positions for several days or weeks.

3.3. Profit Potential

- Day Trading: Aims for smaller, quick profits on each trade, which can add up significantly with high trading volume.

- Swing Trading: Seeks larger profits over a more extended period, capitalizing on broader market moves.

3.4. Risk Exposure

- Day Trading: Reduces overnight risk, but can be exposed to intraday volatility.

- Swing Trading: Faces overnight risks but allows for more time to analyze and respond to market conditions.

3.5. Emotional Strain

- Day Trading: Can lead to higher stress levels due to the fast-paced nature and rapid decision-making.

- Swing Trading: Generally less stressful, allowing for more thoughtful analysis before making trading decisions.

4. Choosing the Right Strategy for You

When deciding between day trading vs. swing trading, consider the following factors:

4.1. Your Lifestyle and Schedule

If you have a demanding job or other commitments, swing trading may be more suitable due to its flexibility. Conversely, if you can dedicate significant time to trading, day trading might be the better choice.

4.2. Risk Tolerance

Assess your comfort level with risk. If you prefer to avoid overnight exposure and are comfortable making quick decisions, day trading could be appealing. If you’re willing to accept overnight risks for the potential of larger gains, consider swing trading.

4.3. Trading Experience

Your level of experience can influence your choice. Beginners may benefit from the slower pace of swing trading to develop their skills, while more experienced traders might thrive in the fast-paced environment of day trading.

5. Tips for Successful Day Trading and Swing Trading

Regardless of which strategy you choose, here are some tips for success in both day trading vs. swing trading:

5.1. Educate Yourself

Knowledge is key in trading. Take the time to learn about technical analysis, market trends, and the tools available for each trading style.

5.2. Develop a Trading Plan

Create a solid trading plan that outlines your goals, risk tolerance, and strategies. This will help you stay disciplined and focused.

5.3. Practice with a Demo Account

Before committing real money, practice your strategies with a demo account to gain experience without financial risk.

5.4. Stay Informed

Keep up with market news and trends to make informed trading decisions. Knowledge of global events can significantly impact your trades.

5.5. Review Your Trades

Regularly review your trades to identify what worked and what didn’t. This will help you refine your strategies and improve your trading skills.

Conclusion

In conclusion, both day trading vs. swing trading offer unique opportunities for traders to profit in the financial markets. Your choice of strategy will depend on your lifestyle, risk tolerance, and trading experience. By understanding the key differences and benefits of each approach, you can make an informed decision that aligns with your financial goals.