The demand for stable and reliable cryptocurrencies has surged, and Ethena’s Synthetic Dollar USDe is capturing attention as a unique solution in the stablecoin market. But what exactly is the Synthetic Dollar USDe? Designed to maintain a stable value while harnessing the flexibility and innovation of blockchain, USDe represents the next step in digital currency. In this article, we’ll explore what makes the Synthetic Dollar USDe different, how it works, and why it could be the future of stablecoins.

What Is Ethena’s Synthetic Dollar USDe?

The Synthetic Dollar USDe by Ethena is a stablecoin, but unlike traditional stablecoins, it’s not backed by physical assets or fiat currencies held in reserves. Instead, Ethena employs advanced synthetic protocols, using algorithms and blockchain mechanisms to keep the value of USDe stable. This innovative approach allows Synthetic Dollar USDe to offer stability without needing a centralized reserve, enhancing its decentralization and resilience in the market.

Why Choose Synthetic Dollar USDe?

- Decentralization: Unlike conventional stablecoins that rely on banks or reserves, Synthetic Dollar USDe operates on a decentralized network, making it more accessible and secure.

- Innovation in Stability: Through sophisticated algorithms and blockchain integration, Ethena’s Synthetic Dollar USDe is designed to maintain its dollar-pegged value with minimal volatility.

- Global Accessibility: With Ethena’s design, Synthetic Dollar USDe is available to users worldwide, offering a stable digital currency option without banking restrictions.

How Does Synthetic Dollar USDe Work?

To understand how Synthetic Dollar USDe maintains stability without traditional backing, it’s essential to explore the mechanisms behind it.

1. Algorithmic Stability Mechanisms

The Synthetic Dollar USDe uses an algorithmic approach to manage its price. By relying on automated protocols, it balances demand and supply, ensuring the USDe remains pegged to the U.S. dollar.

2. Blockchain and Smart Contracts

Ethena employs blockchain and smart contracts to provide transparency and security to Synthetic Dollar USDe. Transactions, supply adjustments, and value maintenance are all automated, eliminating the need for human intervention and reducing the risk of manipulation.

Benefits of Using Synthetic Dollar USDe

Synthetic Dollar USDe brings several advantages over traditional stablecoins, making it an attractive choice for both individual users and businesses.

1. Enhanced Security and Transparency

Since Synthetic Dollar USDe operates on the blockchain, every transaction is verifiable, adding an extra layer of trust. Blockchain technology ensures security, while the synthetic nature of USDe reduces reliance on external assets that might fluctuate in value.

2. Reduced Centralized Risks

Unlike stablecoins tied to fiat currencies stored in banks, Synthetic Dollar USDe operates without a central authority. This reduces vulnerability to government regulations, inflation, or institutional risks that can affect fiat-backed stablecoins.

3. Accessible to a Wider Audience

With the decentralized nature of Synthetic Dollar USDe, users worldwide can access and use it without needing a bank account. This democratization of stable digital currency helps expand the financial reach of cryptocurrency.

Applications of Synthetic Dollar USDe

The uses for Synthetic Dollar USDe are numerous and expanding. Here are some potential applications:

1. Cross-Border Transactions

The Synthetic Dollar USDe can be easily used for cross-border transactions, bypassing expensive bank fees and offering quick, borderless transfers.

2. Decentralized Finance (DeFi)

Within the DeFi ecosystem, Synthetic Dollar USDe provides a stable currency for lending, borrowing, and staking without the risks associated with fiat-backed stablecoins.

3. Stable Investment Options

For investors looking to park their assets in a stable environment, Synthetic Dollar USDe offers a less volatile alternative to other cryptocurrencies, making it a practical choice during market downturns.

How to Acquire and Use Synthetic Dollar USDe

To start using Synthetic Dollar USDe, you need a compatible wallet and access to an exchange that lists USDe.

1. Setting Up a Digital Wallet

A secure digital wallet is necessary for storing Synthetic Dollar USDe. Popular wallets compatible with Ethena’s USDe include [Wallet A], [Wallet B], and [Wallet C].

2. Purchasing USDe on Exchanges

Once you have a wallet, find a reputable exchange offering Synthetic Dollar USDe. Transfer your assets, purchase USDe, and store it in your wallet to begin using it for transactions or investments.

3. Using USDe for Transactions

With Synthetic Dollar USDe in your wallet, you can use it to pay for services, transfer funds, or participate in DeFi applications.

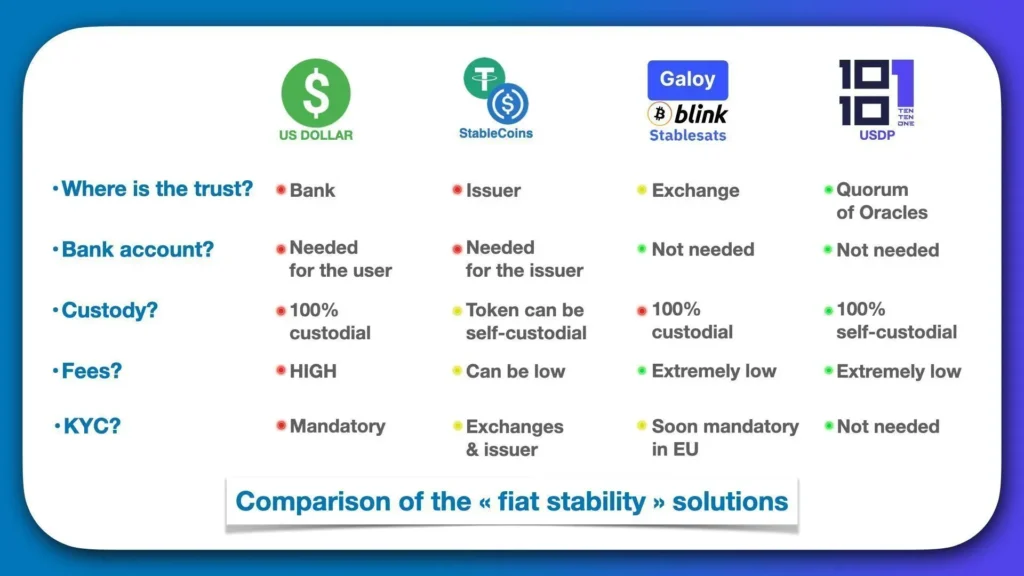

Comparing Synthetic Dollar USDe with Other Stablecoins

While Synthetic Dollar USDe shares some similarities with other stablecoins, its unique synthetic structure sets it apart.

| Feature | Synthetic Dollar USDe | Fiat-backed Stablecoins | Crypto-backed Stablecoins |

|---|---|---|---|

| Backing Mechanism | Algorithmic Protocol | Fiat Reserves | Crypto Collateral |

| Decentralization | High | Low | Medium |

| Risk of Centralization | Low | High | Medium |

The table above illustrates how Synthetic Dollar USDe’s approach can offer benefits that traditional stablecoins cannot.

Potential Risks and Limitations of Synthetic Dollar USDe

Like any cryptocurrency, Synthetic Dollar USDe has potential risks.

1. Market Volatility

Although designed for stability, Synthetic Dollar USDe could still be influenced by market conditions. While algorithmic mechanisms aim to minimize this, there is no guarantee of complete price stability.

2. Technology Dependence

Since Synthetic Dollar USDe relies on blockchain and smart contracts, any vulnerabilities in these technologies could impact its performance. Regular audits and updates are necessary to maintain security.

Future of Synthetic Dollar USDe and Stablecoins

As the demand for decentralized and reliable digital currency continues to grow, Synthetic Dollar USDe and similar stablecoins are likely to gain popularity. Ethena’s synthetic model showcases an evolution in how stablecoins can function without the reliance on traditional financial assets, potentially leading the way for a new era in digital finance.

Conclusion

The Synthetic Dollar USDe by Ethena is a pioneering solution in the world of stablecoins. Through decentralized protocols, algorithmic stability, and enhanced accessibility, Synthetic Dollar USDe offers a viable alternative to traditional stablecoins. As we move toward a more digital financial future, Synthetic Dollar USDe stands out as an innovative and robust choice for users worldwide.

Whether for investment, transactions, or as a stable asset within DeFi, Synthetic Dollar USDe brings significant advantages that could make it the preferred stablecoin in the coming years.