In the volatile world of cryptocurrency, understanding crypto trading indicators is essential for making smart, profitable decisions. These indicators help traders analyze price trends, momentum, and market sentiment, providing critical insights to anticipate future market movements. For both beginners and seasoned traders, these crypto trading indicators can make a significant difference in trading success.

In this article, we will explore the top 5 essential crypto trading indicators that every trader should know in 2024.

1. Moving Averages (MA)

Moving Averages (MA) are one of the most widely used crypto trading indicators for analyzing price trends over specific time periods. Moving averages smooth out price fluctuations, making it easier to identify trends and reversals.

Types of Moving Averages:

- Simple Moving Average (SMA): Calculates the average of prices over a set period, providing a straightforward view of trend direction.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to current market movements.

Using Moving Averages: In crypto trading, the 50-day and 200-day moving averages are often used to determine long-term trends. When the 50-day moving average crosses above the 200-day moving average, it signals a potential upward trend, known as the “Golden Cross.” Conversely, a 50-day moving average crossing below the 200-day is known as the “Death Cross” and signals a potential downward trend.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a popular crypto trading indicator used to assess the momentum of a cryptocurrency’s price. The RSI ranges from 0 to 100, indicating whether a crypto asset is overbought or oversold.

- RSI above 70: This usually indicates that the asset is overbought and may experience a price correction.

- RSI below 30: This suggests the asset is oversold, often signaling a potential buying opportunity.

Using RSI in Crypto Trading: Traders often use the RSI to time their entry and exit points in crypto trades. For example, when the RSI crosses above 70, it might be a good time to sell, whereas an RSI below 30 might present a buying opportunity.

3. Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is another widely respected crypto trading indicator. It shows the relationship between two moving averages of an asset’s price, typically the 12-day EMA and the 26-day EMA.

Key Components of MACD:

- MACD Line: The difference between the 12-day and 26-day EMA.

- Signal Line: A 9-day EMA of the MACD Line, which helps identify potential buy and sell signals.

- Histogram: Displays the distance between the MACD Line and the Signal Line.

Using MACD for Trading: When the MACD Line crosses above the Signal Line, it signals a potential buy. Conversely, a MACD Line crossing below the Signal Line may suggest a sell signal. MACD is especially useful in identifying trends in volatile crypto markets, making it an invaluable crypto trading indicator.

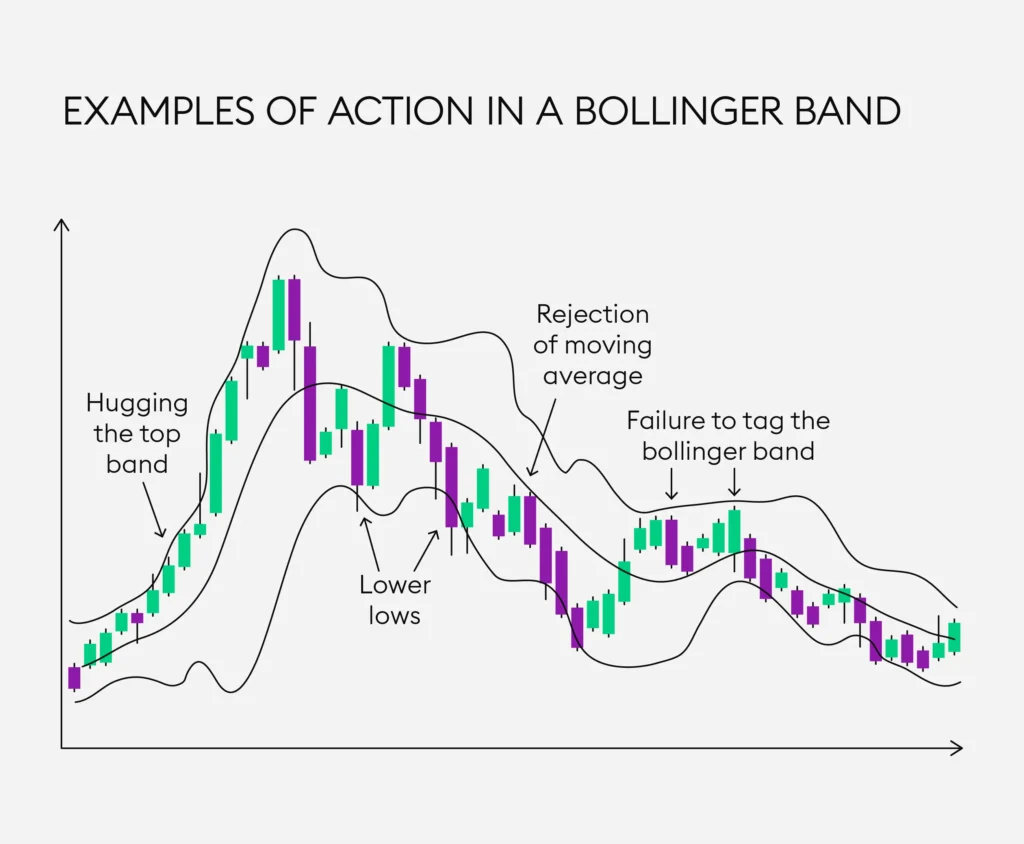

4. Bollinger Bands

Bollinger Bands are a volatility-based crypto trading indicator that helps traders determine overbought and oversold conditions. This indicator consists of three lines: a simple moving average (SMA) in the middle, with an upper and a lower band calculated by adding and subtracting a set number of standard deviations from the SMA.

- Upper Band: Indicates overbought conditions.

- Lower Band: Indicates oversold conditions.

Using Bollinger Bands in Crypto Trading: When the price approaches the upper band, it may be a signal to sell, while prices nearing the lower band could be a buying signal. The width of the bands can also indicate the market’s volatility—wider bands signify higher volatility, and narrower bands indicate lower volatility.

5. On-Balance Volume (OBV)

On-Balance Volume (OBV) is a volume-based crypto trading indicator that helps traders gauge buying and selling pressure by combining volume with price movement. When the price of a cryptocurrency increases along with rising OBV, it’s a sign that buying pressure is building, potentially signaling a bullish trend.

How OBV Works:

- Rising OBV: When volume increases on up days, the OBV will rise, indicating buying pressure.

- Falling OBV: When volume increases on down days, OBV falls, showing selling pressure.

Using OBV in Trading: Traders watch for divergences between price and OBV as potential signals. For instance, if OBV is rising while the price is falling, it might signal an upcoming price reversal.

Conclusion: Mastering Crypto Trading Indicators

Understanding and utilizing these crypto trading indicators can help you make informed decisions, capitalize on market trends, and maximize your trading success. Whether you’re new to trading or a seasoned pro, these indicators provide valuable insights into the market, enabling you to approach each trade with confidence.

By mastering these crypto trading indicators, you can gain a competitive edge in the fast-paced crypto market of 2024.